Greetings to my fellow Waterloo residents! In this post, we’re delving deep into a topic that’s crucial for homeowners yet often not fully understood – managing home equity. For many of us, our home is not just a place of comfort and memories, but also the most substantial financial asset we possess. Effectively managing your home equity is key to leveraging this asset to its fullest potential. Whether you’re a seasoned homeowner or recently stepped into the realm of property ownership, this extensive guide aims to equip you with the knowledge to navigate the complexities of home equity and make sound financial decisions.

Understanding Home Equity

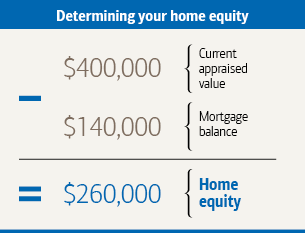

Home equity represents the portion of your property that you truly own, free of any mortgage debt. It is calculated as the difference between the current market value of your home and the remaining balance of your mortgage.

For example, if your Waterloo home is currently valued at $200,000 and you have a remaining mortgage balance of $150,000, your home equity stands at $50,000. This equity is a dynamic figure that can grow over time, either as you reduce your mortgage debt or as the value of your property increases – often a combination of both.

Building Home Equity

Consistent Mortgage Payments: Regular mortgage payments contribute to increasing your equity, as each payment reduces the principal amount of your loan. Opting for a mortgage with a shorter term can accelerate the build-up of equity, although this usually means higher monthly payments. Additional payments towards the principal, separate from your regular mortgage installments, can also boost your equity faster. It’s important to check with your lender if there are any prepayment penalties before making extra payments.

- Strategic Home Improvements and Upgrades: Thoughtful home improvements and renovations can significantly enhance the value of your property, thereby boosting your equity. Focus on upgrades that offer good returns, such as modernizing kitchens and bathrooms, enhancing curb appeal, or adding energy-efficient features. It’s also wise to consider the prevailing trends and buyer preferences in the Waterloo market to ensure that your improvements align with what prospective buyers are seeking.

- Benefiting from Market Appreciation: Property values typically appreciate over time, though this can vary based on market conditions and local factors. In Waterloo, staying abreast of local real estate trends and developments is crucial. Market appreciation can be influenced by several factors, including economic growth, demand and supply dynamics, and neighborhood developments. While market appreciation is less controllable than mortgage payments or home improvements, it plays a significant role in equity growth.

Utilizing Home Equity Wisely

Consolidating High-Interest Debt: If you’re burdened with high-interest debts, such as credit card balances, using your home equity to consolidate these debts can be a wise move. Home equity loans or lines of credit often come with lower interest rates compared to credit cards, potentially saving you a considerable amount in interest payments. However, it’s imperative to approach debt consolidation with a solid repayment plan, as failure to repay could put your home at risk.

- Funding Home Improvements: Investing your home equity back into your property through renovations can be both satisfying and financially prudent. Home improvements not only enhance your living experience but can also increase the market value of your property, further boosting your equity. It’s crucial to prioritize renovations that align with your long-term goals and enhance the overall value of your home.

- Covering Significant Expenses: Using home equity for substantial expenses, such as funding education or managing emergency situations, can be a viable option. It’s important to assess the necessity and long-term impact of such expenses. Home equity should be used judiciously for expenses that offer long-term benefits or are essential, rather than for short-term or discretionary spending.

Risks and Considerations

Risks and Considerations

Leveraging home equity comes with its set of risks and requires careful consideration. The most significant risk is the potential loss of your home if you’re unable to repay the borrowed amount. Therefore, it’s crucial to assess your financial stability and ability to manage additional loan payments. Evaluate the terms and conditions of the equity loan or line of credit, including interest rates, repayment schedule, and any associated fees.

Conclusion

Effectively managing home equity is a crucial aspect of financial wellness for Waterloo homeowners. By understanding what contributes to your equity, increasing it responsibly, and utilizing it judiciously, you can transform your home from a place of comfort into a strategic financial asset. It’s always advisable to consult with a financial advisor to ensure your decisions align with your overall financial goals and circumstances.

In summary, your home is more than just a living space; it’s a key part of your financial journey. With careful and informed management of your home equity, you can pave the way toward a secure and prosperous future.